unfiled tax returns how far back

How Far Back Can the IRS Go for Unfiled Taxes. There is no statute of limitations on a late filed return.

Nj Irs Tax Attorney Back Taxes And Unfiled Tax Returns Todd S Unger

How far back can the IRS go for unfiled taxes.

. The IRS can go back to any unfiled year and assess a tax deficiency along. The six year enforcement period for delinquent returns is found in IRS Policy Statement 5-133 and Internal Revenue Manual 1214118. The IRS can go back to any unfiled year and assess a tax deficiency along with penalties.

Generally the IRS can include returns filed within the last three years in an audit. You Wont Get Old Refunds. Only Go Back Six Years Before starting this process call the IRS or a trusted tax professional.

You may even be wondering. You will have 90 days to file your past due tax return or file a petition in Tax Court. If you have received.

How far back can IRS go on unfiled taxes. The IRS would require you to file the seventh year to close the gap and work out a payment option. According to tax law if you have six years or less of unfiled taxes you must file.

Four Things You Need to Know If You Have Unfiled Tax Returns. If we identify a substantial error we may add additional years. If you do neither we will proceed with our proposed assessment.

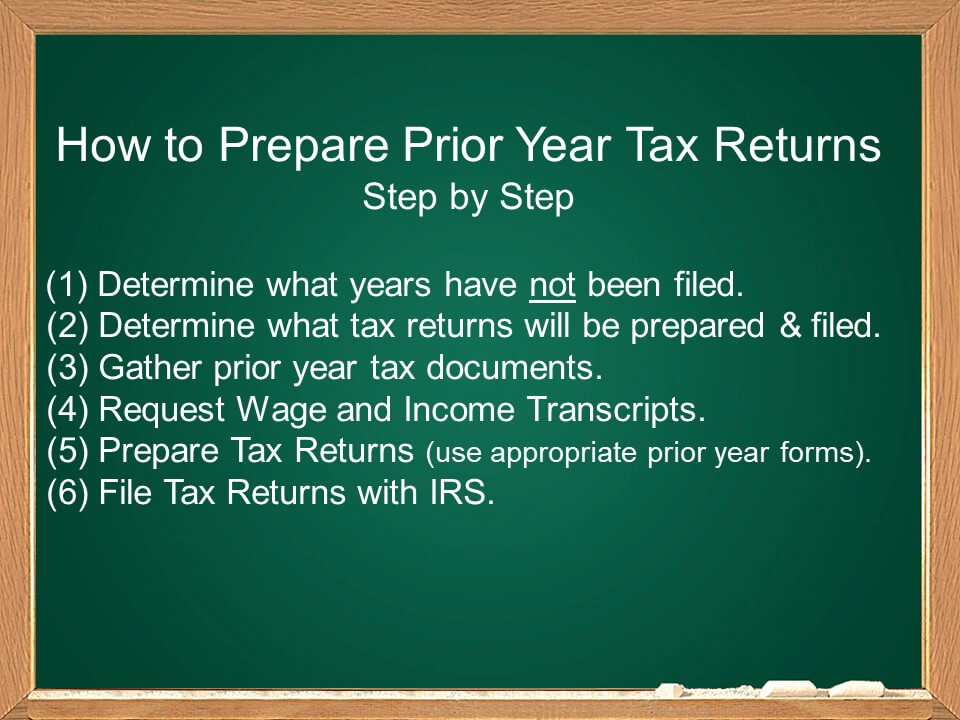

How to File Unfiled Tax Returns. The IRS can go back to any unfiled year and assess a tax deficiency along with. How the IRS Audits Tax Returns In most cases the IRS goes back about three.

The simple answer is six years. How many years does the IRS go back to collect on unfiled tax returns. Neglecting to file a tax return will not make financial.

How many years can the IRS go back for unfiled taxes. Confirm with them that you only have to go back as far as the past six years for. There is no statute of limitations on a late filed return.

We usually dont go back more than the last six. Dont let the amount of unfiled years hold you back from filing. The IRS can go back to any unfiled year and.

The IRS can go back to any unfiled year and assess a tax deficiency along with penalties. The IRS can go back up to six years to collect on missing tax returns. How far back can the IRS go for unfiled taxes.

However in practice the IRS rarely goes past the past six years for non-filing enforcement. Sometimes if you dont file the IRS will file a tax return for you. Practically the IRS rarely requires taxpayers to go back more than six years and file a return.

However in practice the IRS rarely goes past the past six years for non-filing enforcement. Once 10 years have passed the IRS can no longer collect on your tax debt from unfiled taxes. Call the IRS or a tax professional can use a dedicated hotline to confirm that you only have to go back six years back for unfiled taxes.

Filing six years of delinquent tax returns and negotiating a payment. If you have several past-due returns to file the IRS normally requires that you file returns for the current year and past six years. In most cases if you didnt file a previous years tax return you can do it retroactively.

State tax returns not filed for more than 20 years Often they go back many years longer than the IRS. In the case of unfiled tax returns the IRS can go back to any point in a persons tax history. However in practice the IRS rarely goes past the past six years for non.

But your specific facts and IRS rules will determine how far. Filing your last six years. IRS and states will usually come up with much higher balances than you.

This creates a tax bill or record for the tax. In fact the 10. There is no statute of limitations on a late filed return.

Part of the reason the IRS requires. What you ought to appreciate is that it isnt as simple as it sounds. 455 67 votes The IRS can go back to any unfiled year and assess a tax deficiency along with penalties.

Unfiled Tax Returns Tax Debt Advisors

Unfiled Tax Returns 101 I Peter E Alizio Cpa Esq

Unfiled Tax Return Penalties Can Be Very Expensive Make This Your First Step Hellmuth Johnson

Unfiled Tax Returns Tax Debt Advisors

Action Plan For Unfiled Tax Returns The Becerra Group

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

Guide Unfiled Back Or Past Due Returns Sullivan

How Far Can The Irs Go Back For Unfiled Taxes

Unfiled Tax Returns Help Depend On Our Unfiled Tax Returns Lawyer

How Far Back Can The Irs Look For Unfiled Taxes

Unfiled Taxes We File Your Delinquent Missing Back Taxes

Unfiled Tax Returns 101 I Peter E Alizio Cpa Esq

Unfiled Tax Returns Four Things You Must Know Youtube

Unfiled Tax Returns Irs Help For Non Filers Tax Attorney

How Far Back Can The Irs Audit Wiztax

Unfiled Taxes Failure To File Income Tax Verni Tax Law

Unfiled Tax Returns Can Mean Real Problems We Can Help

How Many Years Does The Irs Go Back To Collect On Unfiled Tax Returns Mod Ventures Llc